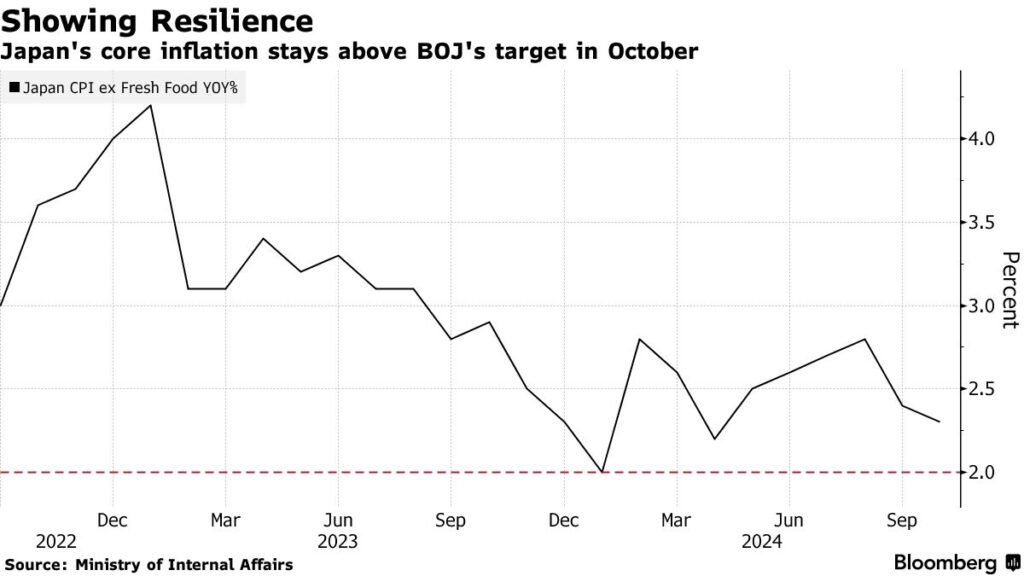

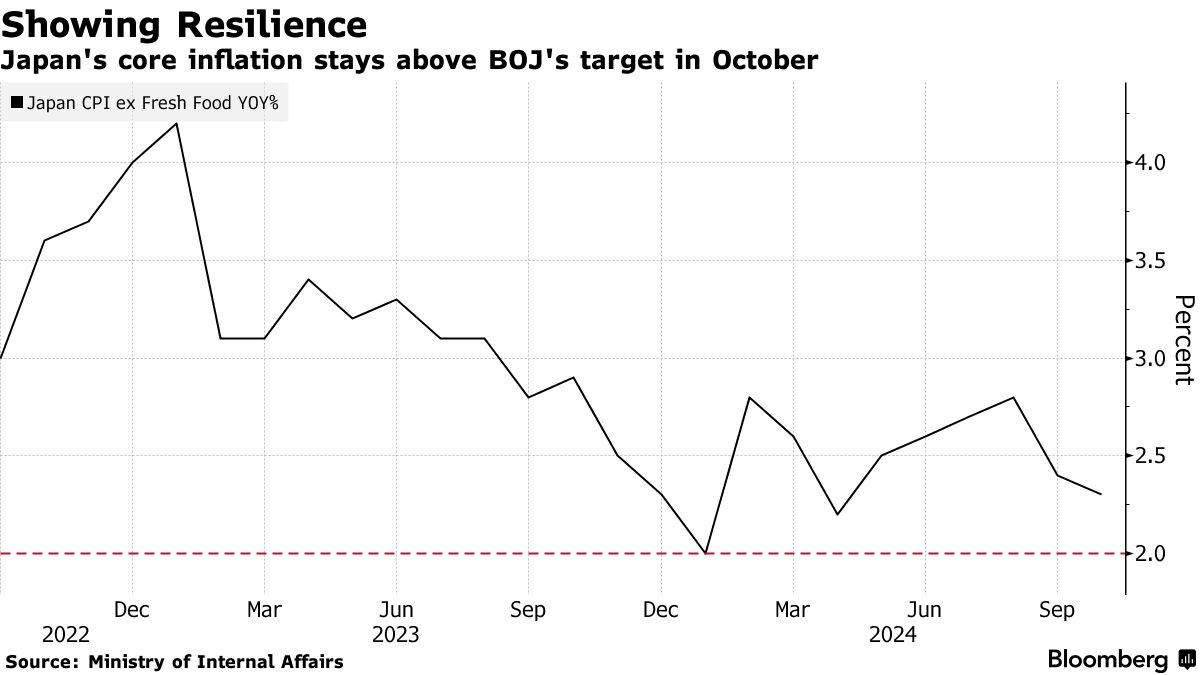

On Friday, November 22, Japan’s core inflation rate fell slightly to 2.3% in October from 2.4% in September. This indicates that inflation is gradually moving closer to the Japanese government’s target rate of 2%, but it is still above 2%, so the market remains cautious about whether a rate hike is appropriate.

The October data is of particular interest because many Japanese companies change their service prices biannually, typically in April and October, the start of the fiscal year.

In October, electricity price growth slowed significantly to 4%, down from 15.2% in September, and natural gas price growth also moderated. In addition, utility subsidies subtracted about 0.54 percentage points from the overall consumer price index (CPI). However, staple food prices, including rice, continue to rise, and other food categories are also seeing deterioration.

Public dissatisfaction, with inflation was a major factor in the ruling party losing its parliamentary majority in last month’s general election, showing that political pressures, not just economic factors, are influencing Japan’s interest rate policy.

통화 정책을 담당하는 전임 전무 이사인 카즈오 모마에 따르면, 통화가 계속 하락하면 BOJ가 단기적으로 기준 금리를 인상할 수 있습니다. 이는 엔화 약세에 대한 하한선이 존재함을 의미합니다.

Currently, the market is expecting a 25 basis point hike to 0.5% at the December 19th monetary policy meeting.