Bonds provide returns to investors through interest, stocks through dividend payments, and real estate through rental income. So how does Ethereum monetize?

When Ethereum switched from Proof of Work (PoW) to Proof of Stake (PoS), it significantly changed the way the network is secured and transactions are validated. Under PoW, miners performed complex computations to create blocks and were rewarded with Ethereum in exchange for their work. However, after the switch to PoS, Ethereum holders stake their Ethereum on the network and receive interest in return.

Since the PoS transition, many investors have been attracted to the Ethereum network’s new reward system. Compared to PoW, PoS allows for more stable and predictable returns. While PoW requires equipment and operational costs to mine, PoS allows anyone with Ethereum to participate in staking, greatly increasing accessibility.

With this change, the Ethereum network transitioning to PoS has advantages in energy efficiency and efficiency in reward distribution, and more users can expect to earn from staking.

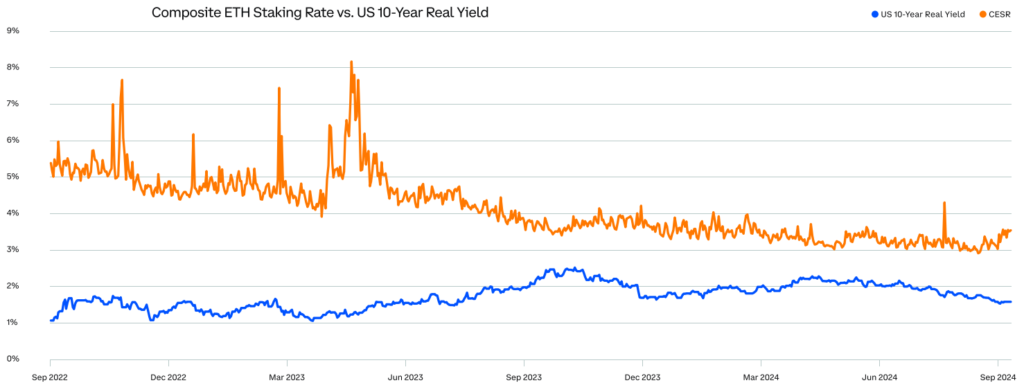

Ethereum staking vs. US 10-year Treasury rates

According to recent data from Coinbase, the Composite Ether Staking Rate (CESR) represents the average annualized return earned by participants staking Ethereum. When comparing the CESR to the inflation-adjusted yield of the US 10-Year Real Yield, it was found that staking Ethereum has been more profitable over the past two years. Ethereum is attracting investors because it offers attractive returns compared to safe-haven assets like long-term Treasuries in traditional financial markets.

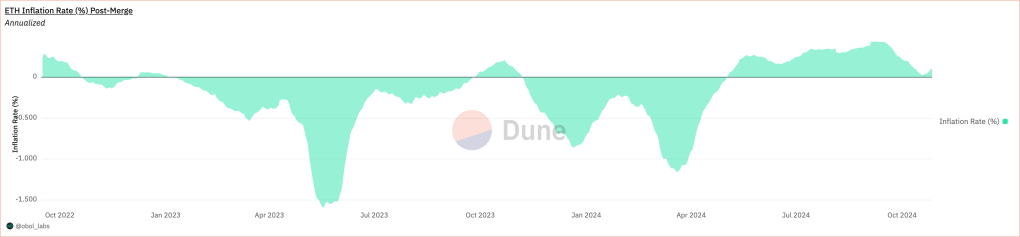

While there were once concerns about inflation as Ethereum’s minting volume increased, since the September 15, 2022 PoS Merge, Ethereum’s inflation has been near zero. Prior to the PoS Merge, there was a net minting of around 15,000 ETH per day, but since the transition, the volatility of minting has been greatly reduced and has remained around 2,000 to 3,000 ETH per day. This change shows the potential for Ethereum to become a deflationary asset, setting the stage for its value to increase in the long term.

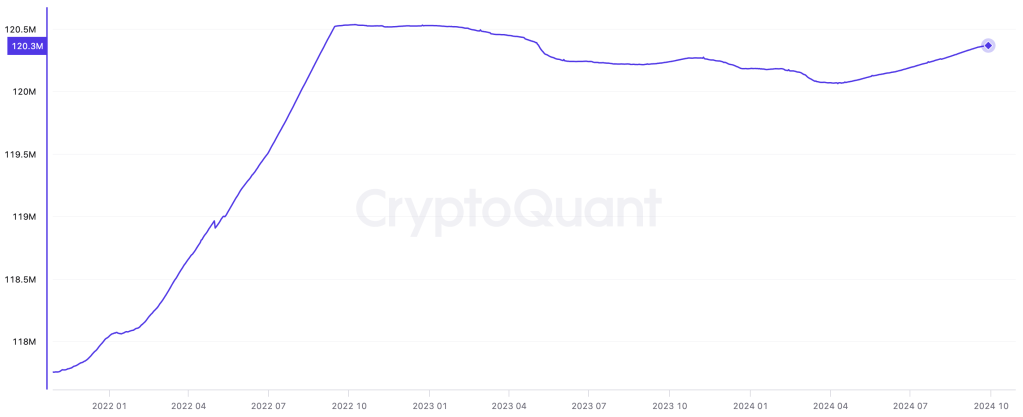

The chart below shows the evolution of Ethereum’s total supply. After the PoS Merge, the total supply of Ethereum, which was around 120 million, dropped slightly until April 2024, and has since started to increase, but at a very slow rate compared to before the PoS Merge. This is a result of the PoS Merge suppressing ETH minting, increasing the likelihood that ETH will function more as a store of value asset.

Ethereum’s inflation rate peaked at 0.44% in September 2024, and dropped to -1.5% in the event of a deflationary event. These inflationary and deflationary characteristics of Ethereum make it quite unique compared to traditional fiat currencies.

Comparing inflation between Ethereum and fiat currencies

Inflation is an important economic indicator in many countries, and central banks around the world, starting with New Zealand in 1990, have adopted inflation targeting. Typically, central banks try to keep inflation within a range of 2% or 1-3%. From a Modern Monetary Theory (MMT) perspective, moderate inflationis generally preferred to deflation. This is to support sustainable growth of the economy, reduce unemployment, and allow for active intervention by the government through fiscal policy.

However, the concept of inflation in Ethereum is different from that of fiat currencies. Direct comparisons are difficult because Ethereum’s inflation is calculated based on minted supply, while fiat currencies measure inflation based on the price of goods and services from a consumer or producer perspective.

Note that

In recent years, there has been a growing view that government bond issuance will increase. A decrease in the attractiveness of government bonds, which are traditionally considered a safe haven asset, could lead to a decrease in demand for government bonds and a rise in interest rates. This could make crypto assets like Ethereum less attractive as an investment.